Special Report

The Iraqi Dinar: Ditch the Hype and Get the Facts

Investing in currencies can be wildly risky and volatile.

It can also drive massive gains from relatively small investments.Just about every currency can be traded against another in real-time, providing tons of potential profits from most currencies in the world.

But what about the Iraqi dinar?

Why are people so crazy about it these days?

Is it really so unique and exotic?

The Iraqi dinar is a currency that has acquired quite a bit of popularity since the Iraq War began in 2003. That popularity has increased tenfold amidst speculation that it will dramatically increase in value.

Why else would the United States government be hoarding more of it than any other nation on the planet (excluding Iraq)?

Did Bush know something we didn't when he asserted that the “war would pay for itself”?

Can we, as investors, find an opportunity here?

We've created this report to make sure our readers have accurate information they can act upon.

Let's get started right when the Iraqi dinar was reborn...

Iraq War

Following the second U.S.-led war in Iraq, the dinar was in a state of limbo.

The old Iraqi dinar, featuring images of Saddam Hussein, had to be completely demonetized and a new batch had to be issued.

The U.S. Dollar (USD) became the de facto currency while the country was virtually rebuilt from scratch. Even to this day, the USD is heavily relied upon by businesses and citizens throughout the economy.

Eventually, banknotes were created in 2003 and the old bills were completely replaced in 2004. These new banknotes led to a cottage industry of sellers sending the new Iraqi dinar to oversea investors who hoped to profit from Iraq's new currency when the economy improved...

The provisional government of Iraq made this legal; the banknotes are exchanged at different rates by companies wanting to turn a profit.

The dinar has gone up in value over the past five years even though it’s not traded on any legitimate foreign exchange. All of the real action has been internal or between central banks through auctions.

The changing exchange rate comes from booming growth in Iraq and long-term devaluation of the USD...

GDP grew at more than 12% last year and the fiscal deficit is a modest 8% of GDP.

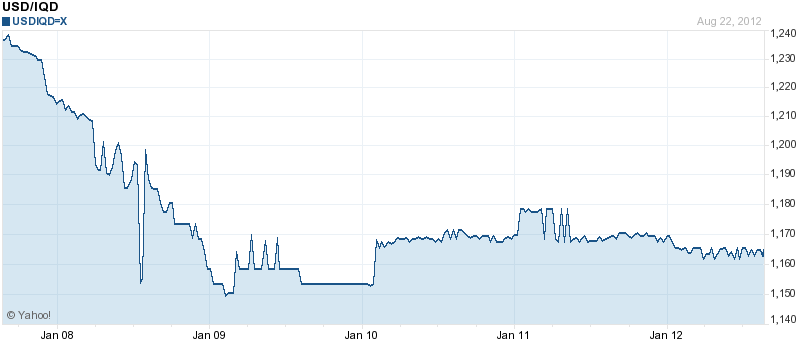

This pair of factors have driven the value of the dinar from 4,000 dinars per USD at the time of their introduction, to a high of 980 dinars per USD.

It has been hovering between 1,160 to 1,170 dinars per USD since early 2010. Iraq was in shambles after two wars and a decade of sanctions and neglect.

Iraq was in shambles after two wars and a decade of sanctions and neglect.

However, it still has 115 billion barrels of proven oil reserves, which puts it third behind Saudi Arabia and Canada. Oil production is at 2.9 million barrels a day with the dream of producing 12 million bbd by 2017.

A number of the world's leading oil companies are working hard to boost production as quickly as possible, which in turn has helped boost the explosive growth rates we've seen since the last war.

The U.S. Government's Off-the-Books Stash

The U.S. Treasury does not officially list the Iraqi dinar as part of the country's Forex reserves. However, the Treasure does say it did an initial currency swap with Iraq to fund their government and ministries.

Exactly how many dinars were traded is never mentioned, but it does make reference to “billions of U.S. dollars” traded to Iraq.

Experts speculate the U.S. government received nearly 4 trillion Iraqi dinars at an exchange rate of 4,000 dinar to 1 USD.

If this is even close to true, at 1170 dinars to one 1 USD, the U.S. government would be sitting on a 340% gain — as would anyone else who speculated on the dinar over the years.And that would give Bush’s statement — “This is a war that will pay for itself” — some weight.

Back and Forth... and Back Again

Rumors of extreme deprecation have become a complex issue. Many sources have bantered back and forth over the past year, entertaining the idea that a serious devaluation may be under way.

However, the Central Bank of Iraq recently attempted to extinguish that notion when it publicly announced an imbalance of the Iraqi dinar exchange rate while simultaneously denouncing rumors that the dinar will soon experience a sharp decline in value.

The Iraqi government planned on pulling three zeros off the end of the currency, which would make for easier math without changing the purchasing power.

Back in September 2011, Alsumaria, an Iraqi satellite television station, reported: “Iraq Central Bank said that it won’t only delete the zeros, but it will also change Iraq monetary structure in order to provide bigger currencies.”

In mid-April, the finance committee in the Iraqi Council of Representatives warned investors and Iraqi citizens how the low exchange rate of the dinar compared to the USD would be detrimental to Iraq's economy. Strict regulations were then mandated on the sale of dollars based on trade restrictions with Iran and Syria.

The Central Bank was expected to withdraw dinars from the market in masses to facilitate the change.

Two days later, everything changed....Iraq officially suspended all previous plans of dropping three zeros off the value of bank notes of its currency, claiming that the economic climate isn't yet “suitable” for such a dramatic restructuring procedure.

To withdraw the 30+ trillion dinars currently in circulation would be an overwhelmingly tedious process that is not on Iraq's agenda, and will not be a priority “until further notice,” according to the cabinet secretary.

It's a curious story, indeed: speculating on something so volatile for which one day devaluation is imminent and the next it's not to be spoken of “until further notice”...

Since then, the plan to change the denominations of dinar bills is now quietly still on the table, although it has been slightly changed.

The new bills with much smaller numbers are tentatively going to be in circulation with the old notes for several years. Gradually the old notes will be phased out as old paper bills are retired.

“The knocking out of zeros from Iraqi paper currency will save Iraqis using massive sums of paper money in their money transactions,” said Central Bank Deputy Governor Mudher Saleh.

Buyer Beware!

There are many dinar dealers on eBay as well as sketchy websites that sell currency with no licensing.

Those dealers and resellers are usually the ones who promote the dinar as a great investment opportunity in forums and other media channels.

Don't forget the dinar is still not traded through regulated exchanges.

Any purchases you make today are unregulated and you will not have the protection that the Chicago Mercantile Exchange and other major currency markets provide.A little bit of common sense goes a long way here. Anyone who tells you that you can make a fortune purchasing Iraqi dinars and then turns around to sell them to you is clearly betting it will never happen.

A Real Opportunity Will Come

As we've seen with the back-and-forth currency policies and announcements, the Central Bank of Iraq is still finding its place in what is essentially a brand-new country.

Once monetary policy stabilizes and the dinar is introduced in legitimate Forex exchanges, we'll have a real opportunity on our hands.

What the Iraqi dinar will do (once it is safely and widely traded) is allow you to bet on a country in the Middle East that is seeing strong growth and constantly improving balance sheets.

As long as oil is in high demand — which will undoubtedly be until the world runs out — Iraq will have plenty of money pouring into its borders. Don't forget that Iraq has the potential to boost exports several times over.

While Iraq is still fighting a culture of corruption, there are few oil-rich countries with more potential. Virtually every other oil exporter is either a closed economy or already highly leveraged with debt...

With the low fiscal deficit of 8% GDP, Iraq will only be slowed by global economic forces — unlike the United States.

Wealth Daily has been following news on the Iraqi dinar for years, and we will continue to keep a close eye on developments while cutting out the hype and chafe.

Keep an eye on Wealth Daily for the latest updates.

There are bound to be numerous opportunities for profit ahead, and we'll let you know as soon as they present themselves.

The Central Bank of Iraq raised interest rates in 2007 in an attempt to allow a gradual appreciation of the dinar. The move will also fight continued use of the USD within the Iraqi economy, although progress has been very slow. Hopefully, it will continue to work on building a strong, competitive, market-based economy.

You can download the PDF version here: The Iraqi Dinar: Ditch the Hype and Get the Facts

Download FREE Affiliate Marketing Templates Every Month...

http://abi1946.kpreseller.hop.clickbank.net

Start Your Own Membership For Passive Recurring Income...

http://abi1946.mymonthly.hop.clickbank.net

Swipe My Money Emails For A Profitable Email Campaign...

http://abi1946.megaemails.hop.clickbank.net

Your First 'Guru-Style' Sales Funnel Built For Your In 24 Hours!

http://jvz4.com/c/24595/18870

Turn-Key MONSTER Pumps $27 Payments Into Your PayPal Account!

http://jvz1.com/c/24595/46411

High Quality Reseller Products Created For You EVERY Month!

http://jvz5.com/c/24595/46411

Compensation Disclosure

This site is compesanted for any purchases made from links on this page.

Even though I may be receive compensation for our posts or advertisements,

I always give my honest opinions, findings, beliefs, or experiances on those

topics or products. http://about.me/abdullahibrahim

No comments:

Post a Comment